Cerca nel più grande indice di testi integrali mai esistito. The amount of tax that must be paid will depend on the tax slab under which you fall.

Irs Playing Fair With Transparent Crypto Tax Filings Filing Taxes Tax Time Income Tax

See this page for contact details.

. Now check out California Office of Tax Appeals decision In the Matter of Blair S. We would like to show you a description here but the site wont allow us. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Back Taxes For Previous Year Tax Returns 2020 2019 2018 2017 etc. Taxpayers can also avail an addition income tax rebate of Rs. 2022 Tax Calculator Estimator - W-4-Pro.

Based on the Household Income and Basic Amenities Survey 2019 the middle class in Malaysia earn between RM4851 to RM10970 per month. Search the worlds information including webpages images videos and more. For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0.

1283 Followers 396 Following 26 Posts - See Instagram photos and videos from Abdou A. Malaysia Residents Income Tax Tables in 2022. Make sure you keep all the receipts for the payments.

The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2021. Malaysian personal tax relief 2021. Online competitor data is extrapolated from press.

We would like to show you a description here but the site wont allow us. See the Emergencies page. What if youve sent in your income tax return and then discover you made a mistake.

31 064 030 324. For salaried employees. 18032402 May 30 2019.

The bonus will be paid for the year 2020-21 as. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Also the M40 group covered 372 of the total household income in 2019.

Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the. Income tax calculation can be done either manually or by using an online income tax calculator. The relief amount you file will be deducted from your income thus reducing your taxable income.

The Tax forms and Calculators Are Listed by Tax Year. Bindley OTA Case No. The combined income tax rebate in India which can be availed under sections 80C 80CCC and 80CCD 1 is capped at Rs.

Contact A Taxpert. The 1012 Tax Bracket. Tax Relief For Resident Individual for Assessment Year 2020.

50 000 under section 80CCD 1B subject to self-contribution or deposit to their NPS account or Atal Pension Yojana. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Below is the list of tax relief items for resident individual for the assessment year 2020. You can make things right by filing an amended tax return using Form 1040-X. 6PM to 9PM weekdays.

Please Login to see scheme specific contacts. PLB amount equivalent to 78 days of wages were paid for the year 2010-11 and 2019-20. If you have to file a prior year individual income tax return forms are listed below by.

Earn money from your site Millions of advertisers compete for your ad space. We would like to show you a description here but the site wont allow us. We would like to show you a description here but the site wont allow us.

That means more money more relevant ads and more ad spaces filled. Google has many special features to help you find exactly what youre looking for. There a nonresident sole proprietor performed all of his services.

Tax Identification Numbers In Laos Compliance By June 2021

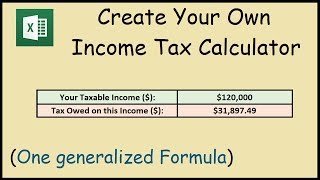

How To Create An Income Tax Calculator In Excel Youtube

Tax Deductions Lower Taxes And Tax Liability Higher Refund

How To Create An Income Tax Calculator In Excel Youtube

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

2019 Personal Income Tax Deduction Category Asq

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

How To Calculate Income Tax In Excel

Do You Need To File A Tax Return In 2019

How To Calculate Income Tax In Excel

Income Tax In Austria For Foreigners Academics Com

Make A Personal Budget With Microsoft Excel In 4 Easy Steps Personal Budget Budgeting Excel

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

What Type Of Income Do I Have Other Income Is Taxable

Supplementary Guidance On Tax Treatment Of Nonresidents Kpmg China

10 Things To Know For Filing Income Tax In 2019 Mypf My

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

/GettyImages-1194842257-3fe0e6dbb62548be88e0941f08a73a01.jpg)